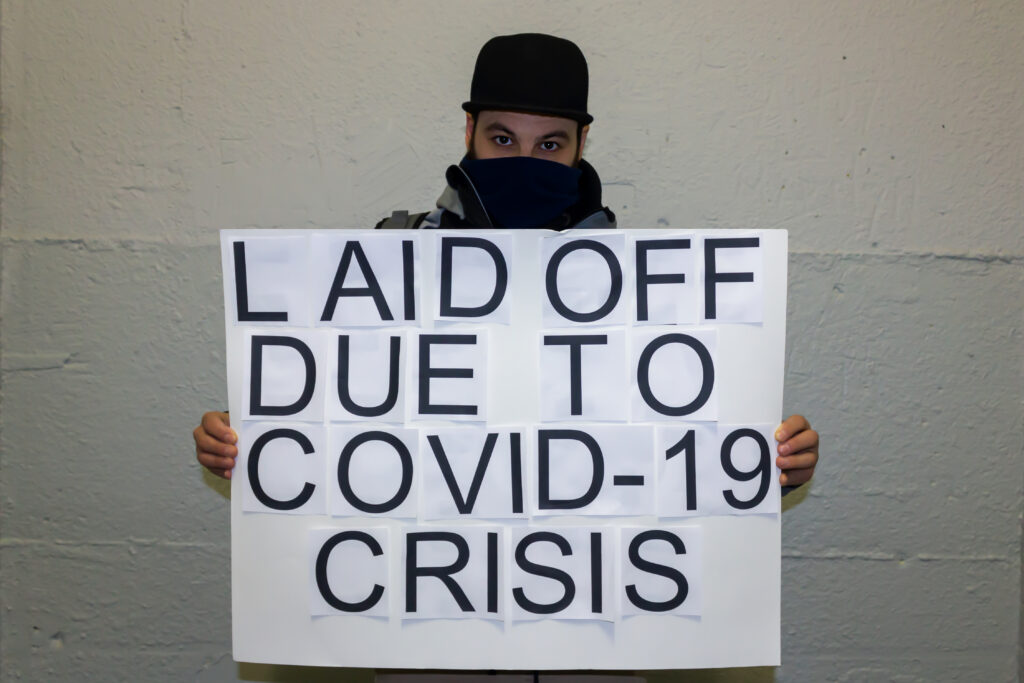

Federal and state programs to provide support for those who are not working

May 5, 2020

|

STATE Unemployment Insurance |

If you have lost your job or had your hours reduced for reasons related to COVID-19 |

Partial wage replacement benefit payments to workers who lose their job through no fault of their own. |

Ranges from $40-$450/week for up to 26 weeks |

www.edd.ca.gov/ unemployment/ eligibility.htm |

|

STATE Paid Family Leave (PFL) |

If you’re unable to work because you are caring for an ill or quarantined family member with COVID-19 (certified by a medical professional) |

Up to six weeks of benefit payment to eligible workers who have a full or partial loss of wages because they need time off work to care for a seriously-ill family member. |

Approx. 60-70% of wages (depending on income); ranges from $50-$1,300/week for up to 6 weeks. |

www.edd.ca.gov/ disability/am_I_ eligible_for_PFL_ benefits.htm |

|

STATE Paid Family Leave (PFL) |

If you’re unable to work because you are caring for an ill or quarantined family member with COVID-19 (certified by a medical professional) |

Up to six weeks of benefit payment to eligible workers who have a full or partial loss of wages because they need time off work to care for a seriously-ill family member. |

Approx. 60-70% of wages (depending on income); ranges from $50-$1,300/week for up to 6 weeks. |

www.edd.ca.gov/ disability/am_I_ eligible_for_PFL_ benefits.htm |

|

STATE Paid Sick Leave |

If you or a family member are sick or for preventative care when civil authorities recommend quarantine |

The leave you have accumulated or your employer has provided to you under the Paid Sick Leave law. |

Paid to you at your regular rate of pay or an average based on the past 90 days. |

www.dir.ca.gov/dlse/ paid_sick_leave.htm |

|

STATE Workers’ Compensation |

If you are unable to do your usual job because you were exposed to and contracted COVID-19 during the regular course of your work. |

Temporary disability (TD) payments would begin when your doctor says you can’t do your usual work for more than three days or you are hospitalized overnight. |

TD generally pays 2/3 of the gross wages you lose while recovering from a work-related illness or injury, up to a maximum weekly limit for up to 104 weeks. |

www.dir.ca.gov/dwc/ FileAClaim.htm |

|

FEDERAL Federal Emergency Paid Sick Leave Benefit |

A) If you are personally subject to quarantine order, experiencing COVID-19 or not or are caring for a quarantined family member. B) If you are caring for a quarantined family member or for a child whose school/daycare is closed. |

A & B) Applies to employees of public or private employers with less than 500 employees. |

A) Two weeks (up to 80 hours) of paid leave at the employee’s regular rate of pay—capped at $511/week. B) Two weeks leave paid at 2/3 of regular rate of pay up to $200/day. |

There are no forms for workers to complete.Talk to your employer; it’s a good idea to have a doctor’s note. |

|

FEDERAL Family and Medical Leave Act (Expanded & Original) |

A) If you are experiencing COVID-19 symptoms or are quarantined by a health care provider. B) If you are caring for a child who’s school/daycare is closed. |

A) If your employer has more than 50 employees and you have worked 1250 hours in the last 12 months. B) If you’ve been employed for more than 30 days and your employer has less than 500 employees. |

A) Up to 12 weeks of job-protected, unpaid leave within a 12 month period b) 12 weeks protected leave with 10 paid at 2/3 of regular pay, up top $200/day |